What is difference between NEFT and RTGS,IMPS-Timings,Transfer limit,Charges

NEFT is the acronym of National Electronic Fund Transfer. In this process, the funds are transferred in batches from one bank account to another. When an individual transfers money from one account to his friend/relative it is not immediately credited but done after in the next settlement cycle which occurs at 60 minutes intervals.

transferred in batches from one bank account to another. When an individual transfers money from one account to his friend/relative it is not immediately credited but done after in the next settlement cycle which occurs at 60 minutes intervals.

transferred in batches from one bank account to another. When an individual transfers money from one account to his friend/relative it is not immediately credited but done after in the next settlement cycle which occurs at 60 minutes intervals.

transferred in batches from one bank account to another. When an individual transfers money from one account to his friend/relative it is not immediately credited but done after in the next settlement cycle which occurs at 60 minutes intervals.

NEFT was an improvement from SEFT (Special Electronics Funds Transfer) and came into effect around December 2005. For this the sender and beneficiary should both be part of the NEFT network.

For more details: Click here

RTGS is acronym of Real Time Gross Settlement. In this process, the funds are transferred between bank accounts real time. As soon the transaction is processed, the funds are created to the beneficiary.

RTGS is fast, without delay and is handled by large corporates for real time transactions. The transaction is accounted in the books of Reserve Bank of India books. So it is irrevocable and final.

For more details: Click here

IMPS is acronym of Immediate Payment Services. In this process, funds are transferred electronically by mobile phone services. The customers use mobile phones as a medium for transferring funds and hence IMPS is a mobile based payment service.

This is facilitated by NPCI (National Payments Corporation of India) and was introduced in 2010.

For more details: Click here

- See more at: http://www.smartmoneygoal.in/blog/difference-between-neft-rtgs-imps-timing-limit/#sthash.GmlpjfFT.dpufDifference between NEFT and RTGS, IMPS

| Transaction Timings | NEFT | RTGS | IMPS |

|---|---|---|---|

| Monday to Friday | 8:00 AM to 7:00 PM | 9:00 AM to 4:30 PM | 24×7 |

| Saturdays | 8:00 AM to 01:00 PM | 9:00 AM to 01:30 PM | 24×7 |

Note: For NEFT, transaction done during the last 2 batches on weekdays and last batch on Saturday will get credited the next working day.

| Transaction Limits | NEFT | RTGS | IMPS |

|---|---|---|---|

| Minimum | Re 1 | Rs 2 lakh | Re 1 |

| Maximum | Rs 10 lakh | Rs 10 lakh | Rs 2 lakh |

| Transaction Charges | NEFT | RTGS | IMPS |

|---|---|---|---|

| Amounts upto Rs 10,000 | Rs 2.50 + Service Tax | Not Applicable | Rs 2.50 + Service Tax |

| Amounts above Rs 10,000 upto Rs 1 lakh | Rs 5 + Service Tax | Not Applicable | Rs 5 + Service Tax |

| Amounts above Rs 1 lakh upto Rs 2 lakh | Rs 15 + Service Tax | Not Applicable | Rs 15 + Service Tax |

| Amounts above Rs 2 lakh upto Rs 5 lakh (Incl. Rs 2 lakh for RTGS) | Rs 25 + Service Tax | Rs 25 + Service Tax | Not Applicable |

| Amounts above Rs 5 lakh upto Rs 10 lakh | Rs 50 + Service Tax | Rs 50 + Service Tax | Not Applicable |

What to do in-case money is not credited: Check out RBI website here

The banks branches participating in NEFT given here

Advantages of NEFT – RTGS – IMPS

- No physical cheques or demand drafts

- Does not need physical presence of individual

- Less fraud and physical instrument misusage

- Confirmation of transaction by SMS or e-mail

- Anywhere access and usage – from home, office, travel

- Almost real time transfer and quick transactions

Top Read post: Investing lessons from Warren Buffet’s life

Hope we have clarified the differences between NEFT and RTGS and IMPS . Did you find this useful. Let us know in your comments below. Subscribe to our newletter for latest updates through e-mail.

Disclaimer: I have made every effort to make sure factual information like timing,charges, limit is correct as on March 2014 . In case you feel any information is incorrect, please point out with official references in COMMENTS SECTION and I will clarify or make necessary changes with a BIG THANKS!.

- See more at: http://www.smartmoneygoal.in/blog/difference-between-neft-rtgs-imps-timing-limit/#sthash.GmlpjfFT.dpuf

for full info click on the link

http://www.smartmoneygoal.in/blog/difference-between-neft-rtgs-imps-timing-limit/Banks as insurance brokers – Is it Good or Bad?

Banks as insurance brokers – Is it Good or Bad?

You may now have few questions – So what’s in it for me? Should I buy insurance from banks? Is it a good idea or bad idea to allow banks to do insurance business? Are we going to witness huge mis-selling by banks? Let us go through the below points and analyze whether this is a good move by the RBI/Govt.

- Who will curb mis-selling? Given the rampant mis-selling that takes place in insurance business it remains to be seen who will curb mis-selling (if it happens). Will it be the RBI or the insurance regulator (IRDA)? On paper, it is mentioned that banks need to ensure that consumers are treated fairly and are responsible for the suitability of products sold to the customer. But, RBI has not prescribed any penalties for failure to comply with these guidelines.

- “Trust” is the key factor in any business. This comes naturally when we do business with a banker. Based on this, you may be taken for granted and your bank may offer unwanted insurance products.

- Your bank has lot of information about you. Both personal and financial. It can hard-sell an unwanted insurance product based on you profile

- An individual agent can provide door-step service. Can a bank provide/afford to do this? If you have a grievance, who will address it? (Bank or insurance company)

- I personally believe that this may turn out to be a WIN-WIN situation for banks and insurance companies. Whereas, it can be a ‘lose-lose’ situation for customers and individual agents.

- Banks can push only those insurance products which offer them high commission. They may not bother about your actual requirements. As per the RBI’s guidelines, no incentive (cash or non-cash) should be paid to the bank staff engaged in insurance broking/corporate agency services by the insurance company. On paper it looks fine but is it possible to execute this guideline.

- The relationship managers or bank staff will surely have their own business targets to achieve. This can easily lead to conflict of interest.

- I do not think Banks will sell Term insurance plans to its customers given the low commission structure.

- Banks can easily cross-sell insurance along with its banking products. They can lure its customers to take unwanted insurance products by providing some freebies on banking products. They may also say that it is mandatory to buy an insurance policy to avail benefits of banking.(loan etc)

- Insurance is not a core product of a bank. The bank staff may not have the bandwidth to sell multiple insurance products.

Insurance players like HDFC, ICICI, State Bank of India (SBI) and Max have a major part of their business coming from bancassurance partners. This change is expected to significantly benefit insurers that do not have a major bank alliance partner. These include Reliance Life Insurance, Exide Insurance, Future Generali, Birla, Bajaj, Aegon Religare, Bharti Axa, Shriram Life and Sahara Life.

We need to wait and see how many banks will take up insurance business as Insurance brokers. IRDA (Insurance Regulatory Development Authority) is also evaluating fresh norms for banks to act as intermediaries.

Insurance penetration and insurance density are more about ‘premiums collected.’ It is not about the quantum of insurance coverage. I believe the quantum of insurance is more important than how much premium you pay on your life insurance policy. If banks can act in good faith and sell insurance products as per customers’ needs, this is surely going to be a turning point in Indian insurance industry.

Meanwhile, let me suggest you to follow KISS (Keep It Short & Simple) principle. Just buy good term insurance plan as per your requirements and affordability. Whether you buy it through a bank or agent or online (directly), it is your choice. Forget about all this buzz and fuss.

Will you buy an insurance policy from a bank? (or) Do you prefer buying it from an insurance agent/online? Share your views. Cheers!

(Remember this point on life insurance – “Any life insurance plan which pays money before you die can be avoided“) ( Image courtesy of David Castillo Dominici & bplanet at FreeDigitalPhotos.net) (Download RBI’s notification & final guidelines on ‘Entry of Banks as Insurance Brokers’)

13 FAQs on Gratuity Benefit Amount & Tax Implications

The general meaning of Gratuity is – ‘a favor or gift, usually in the form of money, given in return for service.’ In employment terms, Gratuity Benefit amount is similar to a bonus, meaning that it is a portion of your salary provided to you, by your employer, for the services rendered on the company’s behalf. Gratuity is a reward for your long and meritorious service.

Gratuity is a defined benefit plan and is one of your retirement benefits offered by your employer. You can generally find Gratuity eligibility details in your CTC (Cost to Company) or Company’s offer letter.

(Meaning of Defined Benefit Scheme is – A plan/scheme in which a certain amount or percentage of money is set aside each year by a company for the benefit of the employee. Gratuity is a defined benefit plan. )

Earlier, it was not compulsory for an employer to reward his employee at the time of his retirement or resignation. But in 1972 the Government passed the Payment of Gratuity Act and made it mandatory for all the employers with more than 10 employees to pay gratuity.

In this post, let us understand about – what is gratuity? How to calculate the gratuity benefit due amount? What is the formula to calculate? Is gratuity amount taxable? What is the applicable tax exemption limit on gratuity benefits? How to calculate the gratuity amount online? What are the income tax implications? …

13 FAQs (Frequently Asked Questions) on Gratuity Benefit Amount

FAQ 1 – Am I eligible to receive Employees Gratuity Benefit Amount?

After completing five years of continuous service with the same company, you are eligible to receive the gratuity benefit. Gratuity shall be payable to ‘you’ (employee) on the termination of your employment after rendering continuous service for not less than five years.

FAQ 2 – When is Gratuity Amount paid?

It is payable..

- On Superannuation (or) Retirement.

- On your Resignation (or) Termination.

- On death or Disablement due to accident or disease.

- On Retrenchment (or) Layoff.

- VRS (Voluntary Retirement Scheme).

(You can check your ‘Full & Final Settlement’ papers to know if you have received the gratuity amount or not.)

FAQ 3 – Is five years continuous service rule applicable to all the above events?

The condition of five years of continuous service is not applicable if employee’s service is terminated due to death or disablement. Your nominee or legal heir can receive your gratuity amount (in the event of death of the employee).

FAQ 4 – Are Temporary staff or Contract workers eligible to receive Gratuity amount?

Temporary staff, contract workers etc., are all eligible (except ‘apprentice’) for the gratuity amount, as long as they are considered as employees of the organization.

FAQ 5 – Is 4 years 10 months (any period above 4.5 years of service) considered as 5 years?

This is one the most frequently asked question and there are various conflicting views available on this one.

In one of the court cases, Madras High Court has held that an employee who has completed 4 years and 240 working days in 5th year will be entitled for gratuity i.e. 4 years 10 months and 11 days.

This judgment may or may not be applicable to you (it depends on the place of your establishment). It is better to contact your HR (Human Resource) personnel to get more clarity regarding this point.

FAQ 6 – How is Gratuity Benefit Amount Calculated? (For the employees who are covered under Gratuity Act)

How to calculate my gratuity amount, is also one the Frequently asked questions. It is calculated based on simple formula as below; (This formula is applicable to all the employees who are covered under the Payment of Gratuity Act, 1972.)

Gratuity = Last drawn salary * 15/26 * No. of completed years of service.

In the above gratuity calculation formula, the definition of ‘last drawn salary’ means, it comprises your Basic Salary + DA (Dearness Allowance if any).

How to treat number of months for the purpose of gratuity calculation after completion of 5 years?Any service which is in excess of 6 months is considered as one year. (Six months and above means even 1 day extra after six months, you are eligible for 1 year gratuity. This is applicable only if you have completed 5 years of service) (Also note that service period calculation is not dependent on ‘5 days or 6 days’ in a week work rule.)

For example – If you have put in 11 years and seven months in an organization, your service period will be taken to be 12 years. But if your service tenure is 11 years and five months, then for the purpose of this calculation your tenure will be taken to be 11 years only.

FAQ 7 – How is Gratuity Benefit Amount Calculated? (For the employees who are not covered under Gratuity Act)

For non-government employees (private company employees), who are not covered under the Gratuity Act, the formula for the calculation of gratuity amount is as below;

Gratuity = Average salary * ½ * No. of years of service

In the above gratuity calculation formula, the definition of ‘Average salary’ means, it comprises, your Basic Salary + DA (Dearness Allowance) + commission (as a percentage of turnover achieved by you, if any). To compute ‘Average Salary,’ you have to consider the average of last 10 months salary (Basic + DA + Commission) preceding the month of your retirement/resignation.

Kindly note that in this case, your service period will not be rounded off to the nearest full year. For instance, if you have a total service of 21 years and 10 months, only 21 years will be considered in the calculation.

FAQ 8 – What is the maximum amount that I can receive as Gratuity Benefit?

Yes, there is a ceiling of Rs 10 Lakh as the maximum gratuity amount that you can receive. As per the above calculations, if you are eligible to get more than Rs 10 Lakh as gratuity, your company is bound to pay only Rs 10 Lakh. (In case your company wants to pay more than 10 L then they can pay it as performance bonus or ex Gratia  )

)

)

)

The ceiling of Rs. 10 lakh applies to the aggregate of gratuity received from one or more employers in the same or different years .

FAQ 9 – How to calculate my Gratuity Benefit amount online?

If you are not comfortable in calculating your gratuity due amount using the above formulas, there are lot of online gratuity calculators that are available. You may consider using the below ones;

FAQ 10 – Is Nomination facility available?

Yes, you can give your nomination by filling Form “F” at the time of joining your company (during new joinee formalities). Employee can nominate one or more members of his/her family to receive the gratuity amount in the event of the death of the employee.

FAQ 11 – My company is not paying gratuity due to financial Loss, can it refuse to pay?

Even if your company is not doing financially well, your company is bound to pay gratuity amount. They cannot cite their ‘financial losses’ as the reason for the refusal.

But, an employer can refuse to pay the gratuity amount, if the services of an employee have been terminated for his/her riotous or disorderly conduct or any other act of violence on his part, during his/her employment. Employers can also deduct the cost of damages (if any) from the gratuity amount.

FAQ 12 – Is my Gratuity Amount Taxable in India? Does Employees Gratuity Benefit has any tax exemption?

Gratuity is considered as your retirement benefit and is tax exempted subject to certain conditions of Income Tax Act. For the intent of taxation on gratuity, employees are divided into two categories:

- Government Employees &

- Private Sector Employees

Any gratuity amount received by an employee (Govt or Private employee) during his service is taxable. But when gratuity is received by the employee at the time of his retirement, death or superannuation then tax exemption rules for government employees differs from private employees.

In case of Government Employees the entire gratuity amount that he/she receives on retirement or on death is exempted from paying any Income tax.

In case of Private employees, they are divided as:

- Private employees covered under the payment of Gratuity Act of 1972.

- Private employees not covered under the payment of Gratuity Act of 1972.

In case, when private employees covered under the payment of Gratuity Act of 1972, any gratuity received is tax exempted to the extent of least of the following:

- Statutory limit of Rs 10 lakh. (Maximum limit / Govt notified amount)

- Last drawn salary * 15/26 * No. of completed years of service.(Refer FAQ 6 )

- Actual Gratuity received by you.

If the gratuity exceeds the limit mentioned above, then it becomes taxable.

Example: Let us understand the above tax exemption rule with an example. Mr Sundaram receives Rs 9 Lakh as gratuity benefit from his employer. As per the Gratuity Act calculation, he is eligible to receive, let’s say Rs 5.5 Lakh. The maximum notified limit is Rs 10 Lakh. Out of these, Rs 5.5 Lakh is the least one. So, the tax exemption is limited to the extent of Rs 5.5 Lakh only. Mr Sundaram has to pay income tax on Rs 3.5 Lakh (Actual gratuity received – Tax exempted gratuity amount.)

For private employees not covered under the payment of Gratuity Act of 1972, any gratuity received is tax exempted to the extent least of the following:

- Statutory limit of Rs.10 lakhs.

- Gratuity = Average salary x ½ x No. of years of service. (Refer FAQ 7)

- Actual gratuity received by you.

(Where the gratuity was received in any one or more earlier previous years also and any exemption was allowed for the same, then the exemption to be allowed during the year gets reduced to the extent of exemption already allowed, the overall limit being Rs. 10 Lakh.)

FAQ 13 – Gratuity received by Employee/nominee/legal heir : Taxable under what ‘head’ of income tax?

Gratuity received by you on your retirement (or) during your service period is taxable under the head “Salary.” It should be shown under the head of “Salaries” while computing your ITR. This is applicable for both Government as well as Private employees.

Whereas, gratuity received by the legal heir (or) nominee is not taxable if the gratuity becomes due/sanctioned after the death of the employee. If the gratuity amount becomes due and paid before the death of the employee then it is taxable under the head ‘Income from Other Sources.’ The nominee / legal heir has to show it in ITR (Income Tax Returns).

So, gratuity benefit amount is not fully exempted from income tax. Be extra cautious while calculating the tax exemption limit that is applicable on your gratuity amount. Do check if you have to pay taxes when you receive your gratuity. Kindly share your comments.

( Image courtesy of Stuart Miles at FreeDigitalPhotos.net)

Can LPG Consumers claim Rs 40 Lakh Insurance?

Do you know that as an LPG (Liquefied Petroleum Gas) consumer, you can claim insurance coverage? Are you aware of your LPG Insurance Policy? LPG consumers are protected for accidental deaths and injuries in case the gas cylinders burst.

Some newspapers have carried articles on this topic(as below), and of late these reports are being widely circulated on Social media platforms (Facebook, Whatsapp etc.,).

- Lokmat Times .

- Deccan Chronicle Article.

- Daily Bhaskar

As per the above media reports, LPG Consumers can claim insurance coverage of up to Rs 40 Lakh, in case of any accidents. This is partly true. LPG accident victims are covered for death and accident, but the insurance coverage is not Rs 40 Lakh, as reported. Also, the oil marketing companies do not take any special insurance policy or coverage for individual LPG consumers.

Both, the LPG companies (oil companies) and the LPG Distributors (Gas agencies) take Third Party Liability Insurance. No premium is collected from the LPG customer. The LPG accident victims can claim insurance from the company and also from his/her local Gas Agency (distributor).

This third party liability policy (public liability policy) provides personal accident cover, reimburses medical expenses and covers property damage at authorized customer’s registered premises. The sum assured given to the accident victims is based on per event (accident) and per person (victim).

I did a little bit of research and found the copy of ‘Public Liability Policy’ taken by Indian Oil (Indane Gas), Bharat Petroleum (Bharat Gas) and Hindustan Petroleum (HP Gas) companies. These companies have taken the insurance policy from United Insurance Company Ltd.,

Below are the insurance coverage details;

- Personal Accident cover – Rs 5 Lakh Per Person Per Event.

- Medical Expenses Max cover – Rs 15 Lakh Per Event.

- Property Damage cover – Rs 1 Lakh Per Event

The maximum ‘limit of liability‘ is as follows;

In addition to the above insurance, the LPG distributors also have third party liability insurance to cover losses, in the event of an LPG accident . I have tried to get the ‘third party insurance cover’ details from my distributor, but without much success. You may also try to get the details from your respective cooking gas distributor. If you are able to source some information, do share the details.

How to claim the insurance in case of an accident?

Procedure to be followed by the LPG customers..

- In case of the unfortunate event of an accident, the LPG customer must immediately inform the distributor in writing. The distributor then informs the concerned oil company and the insurance company about the same.

- Customers are not required to apply to Insurance Company or to contact them directly

- Customers are required to submit to the Oil Company the originals of Death Certificate(s) and Post-Mortem report(s) /Coroners report/Inquest report, as applicable, in case of deaths.

- Customers are required to submit, Original Medical Bills, Doctors’ Prescriptions in original supporting the purchase of the medicines, Discharge Card in original and any other documents related to the hospitalization in case of injuries.

- In case of property damage at customers’ registered premises, the Insurance Co. appoints their Surveyor to assess the loss.

- Your local distributor has to assist you in completing the formalities of an insurance claim.

- To ensure that your claim is not rejected, you should use ISI-mark accessories (such as lighter and gas pipe). You should also ask your gas dealer to carry out maintenance checks at regular intervals.

Every year hundreds of LPG cylinder related accidents are reported. Oil marketing companies and Distributors pay crores of rupees as Insurance premiums. But due to lack of awareness about the LPG insurance policy, not many insurance claims happen.

Actually, Gas Agencies are supposed to display information about the LPG insurance policy on their notice boards. They should inform customers about the insurance cover. But no such measures are being taken.

So, share this information with your friends. Spread the word.

(References : mylpg.in & hindustanpetroleum.com)

Avoid using PAN card as an Identity Proof – Know when to quote PAN

PAN card should be used only where it is specified by the Income Tax Department and in other laws wherever it is mandatory. If you use PAN card as an Identity proof, there are chances that it can be misused to commit financial frauds, crimes and forgery. It can be used to carry out benami transactions.

So, it is very important to know when and where PAN number is to be used.

What is PAN Card?

PAN is a ten-digit alphanumeric number, issued in the form of a card by the Income Tax Department. PAN facilitates linking of various documents including; payment of taxes by an individual, information on investments, loans etc.,

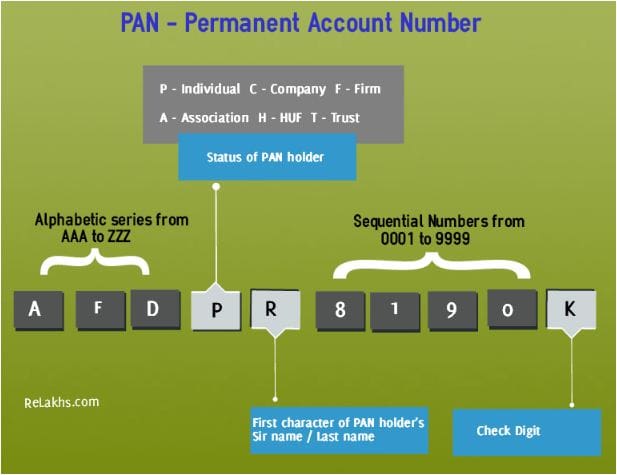

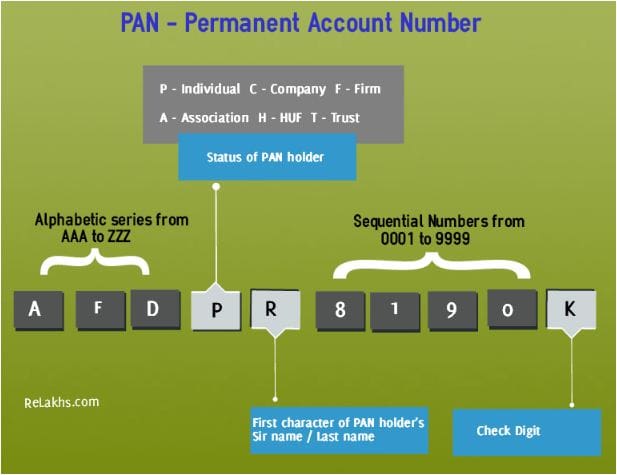

PAN contains ten characters (alphanumeric). The characters are not random. For Example –AFDPR8190K, where the first 5 three characters i.e. “AFD” in the PAN are alphabetic series running from AAA to ZZZ, fourth character of PAN i.e. “P” represents the status of the PAN holder (P for Person / Individual). Fifth character i.e. “R” represents first character of the PAN holder’s last name /surname. Next four characters i.e. “8190” are sequential numbers running from 0001 to 9999. Last character i.e. “K” in this example, is an alphabetic check digit.

Financial transactions where quoting of PAN is mandatory

Below are the financial transactions where quoting your PAN is compulsory.

- As per Budget 2015 quoting of PAN is being made mandatory for any purchase or sale exceeding the value of Rs 1 Lakh.

- On sale or purchase of any immovable property valued at Rs 5 Lakh or more.

- On sale or purchase of a motor vehicle (two wheeler is excluded).

- If you book a Time Deposit exceeding Rs 50,000 with a bank or with a Post Office then PAN should be quoted.

- While buying or selling of financial securities (Shares / Bonds / Debentures) which are valued more than Rs 50,000.

- While opening a Bank account.

- PAN should be quoted while applying for a telephone connection (including new mobile connection).

- Payment to hotels and restaurants against their bills for an amount exceeding Rs 25,000 at any one time.

- Payment in cash for purchase of bank drafts or pay orders or banker’s cheques for an amount aggregating Rs 50,000 or more during any one day.

- Deposit in cash of Rs 50,000 or more with a bank during any one day.

- Payment in cash in connection with travel to any foreign country of an amount exceeding Rs 25,000 at any one time.

- While applying for a Credit or Debit card.

- Payment of an amount of Rs 50,000 or more to a Mutual Fund for purchase of its units.

- Payment of an amount aggregating fifty thousand rupees or more in a year as life insurance premium to an insurer.

- On purchase of bullion which is worth Rs 2 Lakh or more and Jewellery whose value is Rs 5 Lakh or more.

- It is mandatory to provide a copy of your PAN card while obtaining registration under different statutes like Excise, Service Tax, Value Added Tax (VAT) etc.,

- While filing your Income Tax Return.

- If you are staying in a rented property, you need to submit your Landlord’s PAN details to your employer to claim HRA allowance (if HRA exemption is above Rs 8,333 pm or Rs 1 Lakh pa).

- If the person with whom transaction has been entered and if Tax has to be deducted at source, then PAN will have to be given (example – your employer). If PAN is not given then TDS at the rate of 20% will be deducted.

It is advisable to avoid using PAN card / PAN details as an identity proof at any source other than income tax-related matters. Depending on the purpose and requirement (as mentioned above), use it prudently. You may submit other ID proofs like Aadhar card, Voter Id, Driving license etc., if PAN is not mandatory.

Also, you can mention ‘to whom and for what purpose’ you are submitting PAN card copy or PAN card details. For example – for applying HDFC bank credit card. You may quote specific entity name, purpose, date and then sign the PAN copy, to avoid any mis-use.

Life Insurance & Married Women’s Property Act (MWP Act) – Details & Benefits

We buy Life insurance cover to protect ourselves and our family members in case of any unfortunate event. We are also aware that an individual needs to buy adequate Term Plan if his family members are dependent on him / her.

Let’s consider a scenario – Mr. Agarwal is a businessman and borrows some capital to expand his business. He has taken a Term Insurance Policy with his spouse as beneficiary (nominee). After his sudden demise, his creditors approached the court and asserted their right to get paid out of the proceeds of the Term Insurance policy.

In this example, though Mr. Agarwal has taken a term insurance policy, his family has not benefited from it. The claim proceeds (death benefits) are given to his creditors.

In today’s world, ‘buying on credit’ has become a common thing. Whether employed or self-employed, most of us buy on credit (home loan, personal loan, consumer loan etc.,). In this kind of scenario, how to make sure that only your dependents receive the insurance policy claim proceeds.

Are you aware of the Married Women’s Property Act 1874 (MWP Act)?

MWP Act was created to protect the properties owned by women from relatives, creditors and even from their own husbands. The Act has been created to protect women’s rights, even after marriage. MWP act is applicable for all married women of all religions. ‘Section 6‘ of the MWP Act covers Life Insurance plans.

If you take an insurance policy under MWP Act, your life insurance policy is treated as a TRUST and you can be assured that the policy money will be given to your nominee(s) only. The claim proceeds are free from creditors, court and tax attachments.

In this post, let us discuss and analyze the benefits to family members when a life insurance policy is taken under the MWP Act.

gist of MEETING HELD AT LIC CENTRAL OFFICE MUMBAI with LIAFI

DEAR SIR

THE FOLLOWING ARE THE

GISTS OF THE INFORMAL CONSULTATIVE COMMITTEE MEETING HELD AT LIC CENTRAL OFFICE

MUMBAI. THE FOLLOWING ARE THE GISTS. DETAILED INFORMATION WILL BE SENT SOON.

GISTS;

1 .REVIEW OF

ESCALATION CLAUSE AND NON DETACHEMTNE OF SUPERVISORY AGENTS UNDER ACTIVE

CONSIDERATION.

2 ENHANSEMENT OF GROUP

INSURANCE COVERAGE TO CLUB MEMBERS AND NON CLUB MEMBERS WILL TAKEN UP.

3 .LIC WILL TAKE CARE

OF ERC AND HRC.

4. 2ND HOUSING LOAN

UNDER CONSIDERATION.

5 .PROPOSAL TO BE

SUBMITTED BE DIRECT AND CARRIER AGENTS ARE TO BE SUBMITTED.

6 .EMPOWERING OF

EMPOWERED AGENTS WILL BE TAKEN CARE.

7 .SUGGESTIONS SOUGHT

FOR UPDATING AGENTS AND MERCHANT PORTALS.

WITH REGARDS

N GAJAPATHI RAO

SECRETARY GENERAL

LIAFI

Life insurance is a long term contract and meant to provide your loved-ones financial protection when you are not there hence you need to pay little attention while buying a life insurance policy.

And if you are going to buy a life insurance policy for the first time in your life then here are some tips to help you to choose right product. Usually, we buy a life insurance policy on someone’s recommendation; it is not the right way.

Evaluating need: First and foremost reason for buying a life insurance policy should be its requirement. You need to analyze do you really need it. If you have dependents and you are sole breadwinner of the family then it must undoubtedly be your top priority to have a life insurance policy.

Type of policy: After this, you need to think which type of policy will help to achieve your financial goal, whether you need only term cover, or a traditional policy or a unit-linked insurance plan (ULIP). If you need protection at minimal cost then you can go for a term plan. If you are a conservative investor then and need savings element with protection then you can opt for a traditional policy. And if you have a risk appetite, then go for a ULIP.

Coverage amount: After that you need to ascertain how much coverage you need. Having less coverage defeats the whole purpose of insurance. Usually, to ascertain right amount of coverage, you can take in account your all outstanding loans, education and marriage expenses of your children and ten times of your annual income to arrive at a coverage amount.

Right company: As life insurance is a long term contract, choosing the right company becomes imperative. As your family members have to deal with the company to claim the amount hence choose a company that has a good track record in claim settlement.

Comparative study: Don’t buy a policy just because someone have recommended to you. Give little time to compare plans available in the market. And then choose the best and most affordable product that suits your needs.

Posted by Namrata, In Articles,Life Insurance,Uncategorized,

vinay mohanty

Subscribe to:

Posts (Atom)