PAN card should be used only where it is specified by the Income Tax Department and in other laws wherever it is mandatory. If you use PAN card as an Identity proof, there are chances that it can be misused to commit financial frauds, crimes and forgery. It can be used to carry out benami transactions.

So, it is very important to know when and where PAN number is to be used.

What is PAN Card?

PAN is a ten-digit alphanumeric number, issued in the form of a card by the Income Tax Department. PAN facilitates linking of various documents including; payment of taxes by an individual, information on investments, loans etc.,

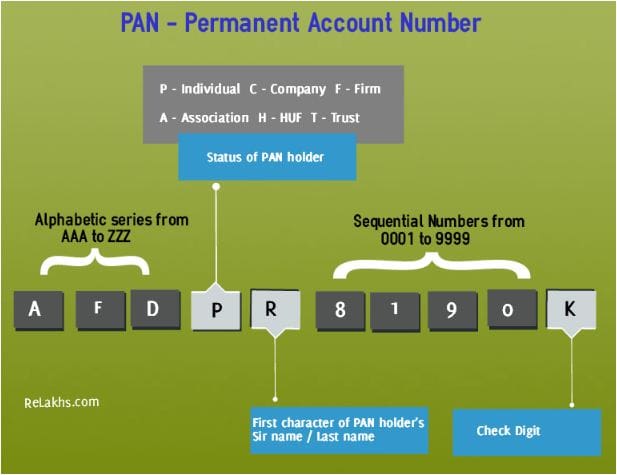

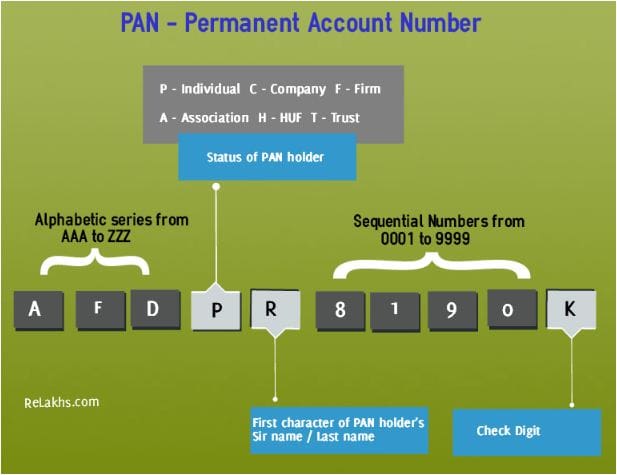

PAN contains ten characters (alphanumeric). The characters are not random. For Example –AFDPR8190K, where the first 5 three characters i.e. “AFD” in the PAN are alphabetic series running from AAA to ZZZ, fourth character of PAN i.e. “P” represents the status of the PAN holder (P for Person / Individual). Fifth character i.e. “R” represents first character of the PAN holder’s last name /surname. Next four characters i.e. “8190” are sequential numbers running from 0001 to 9999. Last character i.e. “K” in this example, is an alphabetic check digit.

Financial transactions where quoting of PAN is mandatory

Below are the financial transactions where quoting your PAN is compulsory.

- As per Budget 2015 quoting of PAN is being made mandatory for any purchase or sale exceeding the value of Rs 1 Lakh.

- On sale or purchase of any immovable property valued at Rs 5 Lakh or more.

- On sale or purchase of a motor vehicle (two wheeler is excluded).

- If you book a Time Deposit exceeding Rs 50,000 with a bank or with a Post Office then PAN should be quoted.

- While buying or selling of financial securities (Shares / Bonds / Debentures) which are valued more than Rs 50,000.

- While opening a Bank account.

- PAN should be quoted while applying for a telephone connection (including new mobile connection).

- Payment to hotels and restaurants against their bills for an amount exceeding Rs 25,000 at any one time.

- Payment in cash for purchase of bank drafts or pay orders or banker’s cheques for an amount aggregating Rs 50,000 or more during any one day.

- Deposit in cash of Rs 50,000 or more with a bank during any one day.

- Payment in cash in connection with travel to any foreign country of an amount exceeding Rs 25,000 at any one time.

- While applying for a Credit or Debit card.

- Payment of an amount of Rs 50,000 or more to a Mutual Fund for purchase of its units.

- Payment of an amount aggregating fifty thousand rupees or more in a year as life insurance premium to an insurer.

- On purchase of bullion which is worth Rs 2 Lakh or more and Jewellery whose value is Rs 5 Lakh or more.

- It is mandatory to provide a copy of your PAN card while obtaining registration under different statutes like Excise, Service Tax, Value Added Tax (VAT) etc.,

- While filing your Income Tax Return.

- If you are staying in a rented property, you need to submit your Landlord’s PAN details to your employer to claim HRA allowance (if HRA exemption is above Rs 8,333 pm or Rs 1 Lakh pa).

- If the person with whom transaction has been entered and if Tax has to be deducted at source, then PAN will have to be given (example – your employer). If PAN is not given then TDS at the rate of 20% will be deducted.

It is advisable to avoid using PAN card / PAN details as an identity proof at any source other than income tax-related matters. Depending on the purpose and requirement (as mentioned above), use it prudently. You may submit other ID proofs like Aadhar card, Voter Id, Driving license etc., if PAN is not mandatory.

Also, you can mention ‘to whom and for what purpose’ you are submitting PAN card copy or PAN card details. For example – for applying HDFC bank credit card. You may quote specific entity name, purpose, date and then sign the PAN copy, to avoid any mis-use.

It is advisable to avoid using PAN card / PAN details as an identity proof at any source other than income tax-related matters. Depending on the purpose and requirement (as mentioned above), use it prudently. You may submit other ID proofs like Aadhar card, Voter Id, Driving license etc., if PAN is not mandatory. track pan card status

ReplyDelete